Don't miss another statutory requirement deadline

Where efficiency meets expertise

Our AI-driven technology paired with industry experts provides streamlined compliance processes and lowers risk.

Our AI-driven technology paired with industry experts provides streamlined compliance processes and lowers risk.

Exactera Transfer Pricing is a complete solution delivered by transfer pricing experts and powered by AI. It is the intelligent approach to transfer pricing and exemplifies the intersection of human and machine intelligence. One centralized solution for localized compliance with reduced risk at a lower cost.

The R&D tax credit is the largest annual tax credit available to U.S. companies and applying for the credit is easier and more affordable than you think, thanks to our R&D tax credit software-based services. Ensure you are getting the maximum R&D tax credit you are entitled to and streamline the process with Exactera.

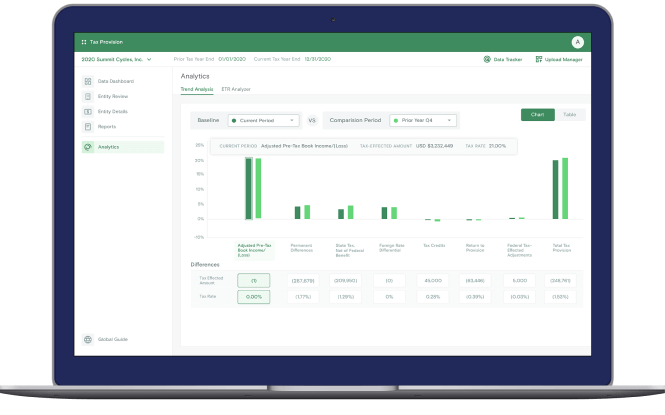

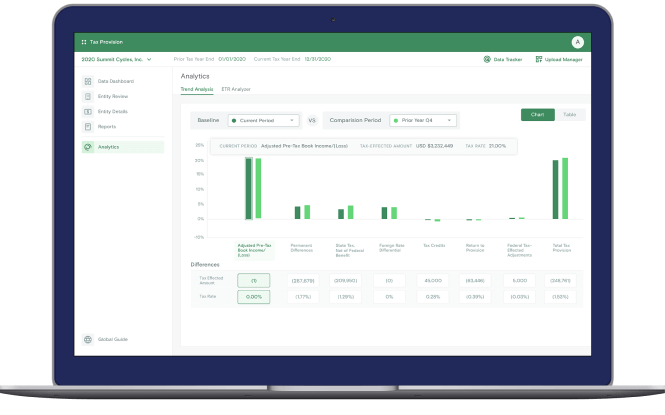

Exactera Tax Provision bypasses the usual Excel roadblocks—broken links, data-entry errors, workbooks that don’t flow seamlessly—and helps automate the book-to-tax process, computes complex calculations swiftly and accurately, and produces audit-ready standard reports, including the a detailed tax account roll-forward (TARF). Our customers reduce the time to complete their tax provision by up to 65%, saving weeks of time.